Time to read:

Since our blog, “Quick Money Hacks” (link below), did so well, I am back again with even more insane hacks to save you money while camping.

Before we get started:

Please subscribe to stay in the know:

(We hate spam too & promise not to bombard your inbox!)

Without Further Ado … How to Save Money While Camping:

1. Recyle Your Dryer Sheets

You can use dryer sheets more than once. Pop them bad boys into the dryer for a load of clothes as normal. When your laundry is done and the sheet is dry replace it in the box to reuse next time! You can easily get three or four loads of great smelling laundry from the same sheet this way.

2. Save on You Energy Bill

When you leave on vacation, or for a weekend escape, unplug all of your small appliances like your Alexa, TVs, alarm clocks, and anything else you can reach! Don’t pay for that “phantom” energy.

3. A Gourmet Date

Next time you go on a date with a potential cutie pie, make sure to split the meal & the check. This saves a TON of money!

4. Stock Up on Sauces & Utensils

Next time you are at a local restaurant or order takeout, make sure to get extra napkins, utensils, and sauce packs in your bag to take home. Why buy this stuff at the grocery store when they are giving it away for free?

5. Old Fashion

If you have found yourself gaining weight and those old pants do not fit you anymore, don’t worry about buying a new pair. Instead, leave them unbuttoned & just use a shoe string to hold them onto your waist! No need to zip the zipper or button them up, or to waste money on the newest fashion trends!

6. It’s Raining Cats and Dogs!

Is your car looking a little dirty? Time for a wash? Check your local weather channel for the next time it will rain. When it does, run out there and wash your car with the assistance of Mother Nature! No garden hose required. This also applies for your pets, or yourself for that matter.

7. Got Junk?

You don’t need to buy trash bags – EVER. Instead, save grocery bags when you go shopping and use them for all of your trash needs! They’ll fit the majority of your small bathroom, & office trash cans. For the kitchen & larger bins, use these mini-bags to take trash out in smaller portions – this will keep your trash can from piling up too.

8. Re-wear Clothing

You can rewear the same outfit at least 3 times before you truly need to wash it. Especially if you aren’t sweating or doing any intense work! Jeans & thicker materials can go even longer.

9. Movie Popcorn

I’ll admit that I stole this one from a story Rachel Cruze of the Ramsey Show told, but it’s brilliant. Order a bag of popcorn from the movie theatre and enjoy your movie! When you leave, fold up the popcorn bag and put it in your pocket. Next time you see a movie, bring the used popcorn bag, pop it open, & get that free refill at the concessions. This hack allows you to only pay for that over-priced movie popcorn once with unlimited refills!

10. Restroom Etiquette

The rules for the bathroom goes as follows: if it’s yellow, let it mellow. If it’s brown, flush it down. This saves thousands on your water costs.

11. Ziplock Baggies

Don’t keep buying these bad boys. After you use one, rinse it out in the sink and let it air dry. Next time you need to store your favorite snack it’ll be clean like a brand new bag.

12. Interior Designer

Visit a couple of your local hardware stores and request free paint samples in a multitude of colors from each. Take the samples home and use them to paint your walls a new, lively rainbow – for FREE! Who said HGTV has all the tricks? Stay tuned in here.

13. Spooky Season

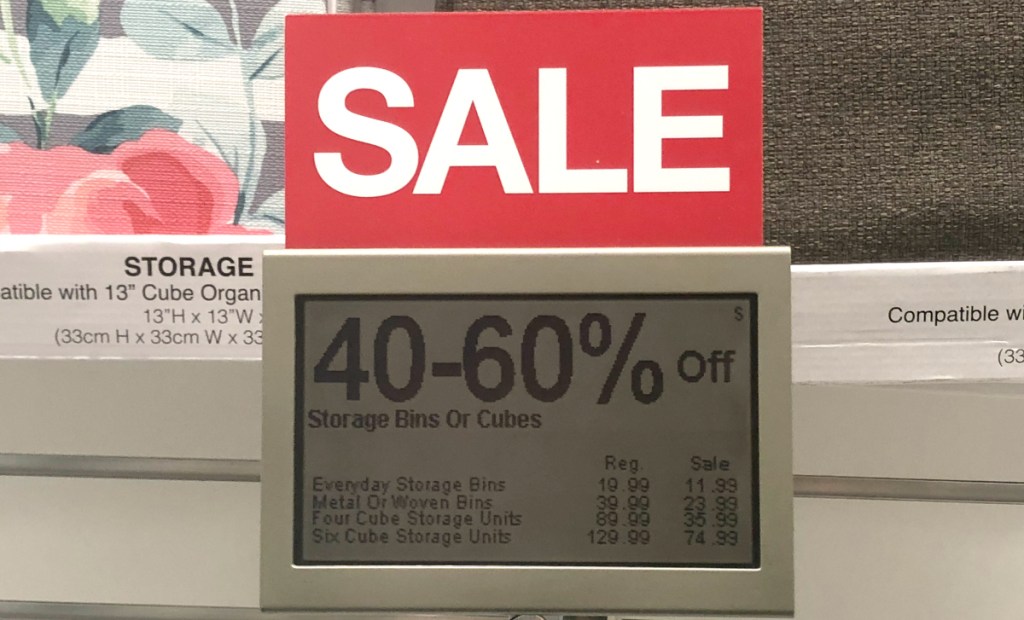

Right after Halloween, during the first two weeks of November is when they mark down all of the candy that didn’t sell. Stock up on all of your favorites at 50% off – or more. You can then use the leftover Halloween candy for Christmas stockings! The same concept applies for Valentines’ Day chocolates & Easter baskets.

14. Water Isn’t $3 a Bottle

After you have a nice Aquafina or Dasani bottled water bottle, refill it with tap water as much as you want instead of buying a fresh bottle. This works even better at a public place like school or work, where you don’t have to pay for the water yourself – FREE refills.

15. Hang Paper Towels Up for Later

Why keep buying those pesky paper squares if you can re-use them again later? Hang paper towels up to dry & then re-use them – you can easily get three of four uses out of paper towels before they begin to tear.

16. Wash Your Clothes in the Campground Shower

You can skip the laundromat after camping by just washing your stuff in the bath-house shower before you leave. Better yet, take a shower with some of the clothes on and you’ve slayed two birds with one stone.

17. Store Campground Water to Drink Later

You will have a water hook-up spigot at almost every RV campsite. If not, there’s definitely a water fill-up somewhere near the dump station. Make sure to fill up a few gallons of water in your left over water jugs & bottles for later. This saves you a few million dollars every week.

18. Free Coffee While Traveling

Stop into a local hotel to get some free coffee in the lobby. When you enter, you should see it sitting right out in the breakfast area. Just walk in, grab a cup, add sugar the way you like it, and head off. If they ask, you’re in room 301.

19. Who Uses Trash Bags, Man?

Next time you’re at the local dog park or see doggy relief stations, make sure to snatch up a few bags. You can use these for your dog later, as a food storage bag to put things in and tie closed, or as miniature trash bags – for FREE.

20. Try Carpool Trash Service

We’re pitching a new idea here – carpool trash service. Consider this a new service where you can drop off your trash and bags at your neighbor’s doorstep and they’ll take care of it bringing it to the dumpster for you. They have to go at some point anyway, so might as well save yourself the extra steps & effort.

21. Share the Warmth

Is it cold outside and you find yourself needing some warmth while camping? Check which of your neighbors left some firewood stacked outside and grab a few logs. This will help you stay warm, and they won’t mind – sharing is caring!

22. Luck o’ the Irish – FREE drinks

Did the neighbor leave out their cooler? Check what’s on tap – it might be a tasty new cider or a banger of an IPA. You never know. They won’t notice a few bottles missing & you’re getting to try out new beers you may have never had.

23. Be the Campground DJ

How much did you pay for your last concert ticket? Probably close to $200 per person, right? Why should you make everyone pay that much when you can become the campground DJ? Break out the bluetooth speaker, blare your music at full volume, and save your neighbors the concert ticket fees.

24. Puppy Play Day

We just had this happen to us at a campground and loved it. When you leave for the day to go sight-seeing, driving through the city, or doing a local hike, make sure you leave your camper windows wide open back at the park. Fido needs the fresh air and will also provide a free alarm system for your neighbors. This works best when your dog is a constant barker – keeping your neighbors safe by barking and keeping an eye out for danger.

25. Family Showers!

Have everyone wear bathing suits and shower together as a family so that you can save money. Why shower four separate times when you can do it all in one? Let’s preserve the environment & save some water for the fishes, man.

26. More FREE Water

When you’re out hiking and see a running source of water like a creek or river, plop your bottle down in there to refill it. If it makes you feel better, grab a Life Straw to help filter the water extra for drinking. Nature provides all that we need!

27. What’s the Wi-Fi Password?

You could buy an expensive Starlink for $699 or a T-Mobile Inseego Hotspot for $399 to get internet while on the road. But why do that? Surely someone at the campground has a network without a password – hack in & surf the web for FREE.

28. It’s On the House

It’s always beer-30 when you can find a great ale in the neighbor’s cooler like we mentioned above. But we’re not savages – be sure to recycle. Once you drink their beer, take back the bottle and leave it for them. I’m sure they care about the environment too, and in places like California, you can get them 5 cents back per bottle – win-win for everyone!

29. Make Your Own Path

Why follow the sidewalk to walk all the way around your campsite and the neighbor’s to get to the bathroom or shower house? By walking straight through their campsite, you can save on steps. Going through their campsite will also allow you to scope out their stuff for potential sharing opportunities.

30. Clearance Sale!

Amazon has frequent sales on outdoor furniture, but why pay for anything? It’s always on clearance over at your neighbor’s campsite. Eye something you fancy that they have – like that zero gravity chair? Bring something you have & swap out. Trading your $5 bag chair is a great way to upgrade and it can’t be stealing if you leave something behind for them to enjoy – it’s a fair trade.

APRIL FOOL’S DAY!

If you’ve gotten this far, we want to personally thank you for your time & hope this brought a smile to your face & a chuckle to your heart. It’s April Fool’s Day after all. If we made you laugh would you consider SHARING this blog with a friend? Use the buttons below or copy the link provided!

Copy this link: https://atomic-temporary-195534999.wpcomstaging.com/extreme-cheapskates/

For even more (real) camping & travel content, follow us on social media here:

![10 Tricks for the [Perfect Trip]](https://noplacelikegone.com/wp-content/uploads/2023/12/d3423-wp-10-tricks-for-the-perfect-road-trip-1200-c397-1200-px.png?w=580)

![What’s Your [Camping] Type?](https://noplacelikegone.com/wp-content/uploads/2023/12/cac39-rvs-explained.jpeg?w=580)