Wow, that’s a headline huh … according to many studies, the average car payment of Americans is up over a record breaking $700 for the FIRST time in history. Not to mention that the average new car being sold now is around $47,000 off the dealership lot. Oh, and you have to pay all of these new “dealership markup fees” because of Covid-19. Let’s insert the awfully high prices of gas around the nation right now as well, being close to $4/gallon on average.

See, just a few years ago it used to be that you could finance a new car for 12, 24, 36, 48, and 60 months depending on various factors. Within just the last decade, the car loan term has expanded from 4-5 years to now 6-8 years being the standard practice. Because new and used car prices are at all time highs in history right now, lenders are taking advantage of capitalizing on more profit through interest. To the average person, buying a car seems easier because the price tags aren’t as important, but because the loan term can be reduced to a smaller and smaller monthly payment for flexibility.

Ditch the Car Payment

The average car payment in America is close to $700/month and that leaves me in actual fucking awe. Maybe I’m just not the “average” person in America. I’m weird. Outside of the box. I’d rather pay much, much less for my car – and enjoy a hefty savings account. Better yet, invest a chunk of that money into my future retirement.

Did you know that an investment of $700/month could make MOST people a millionaire in their retirement? Because I did, and I’m here to share that knowledge with you.

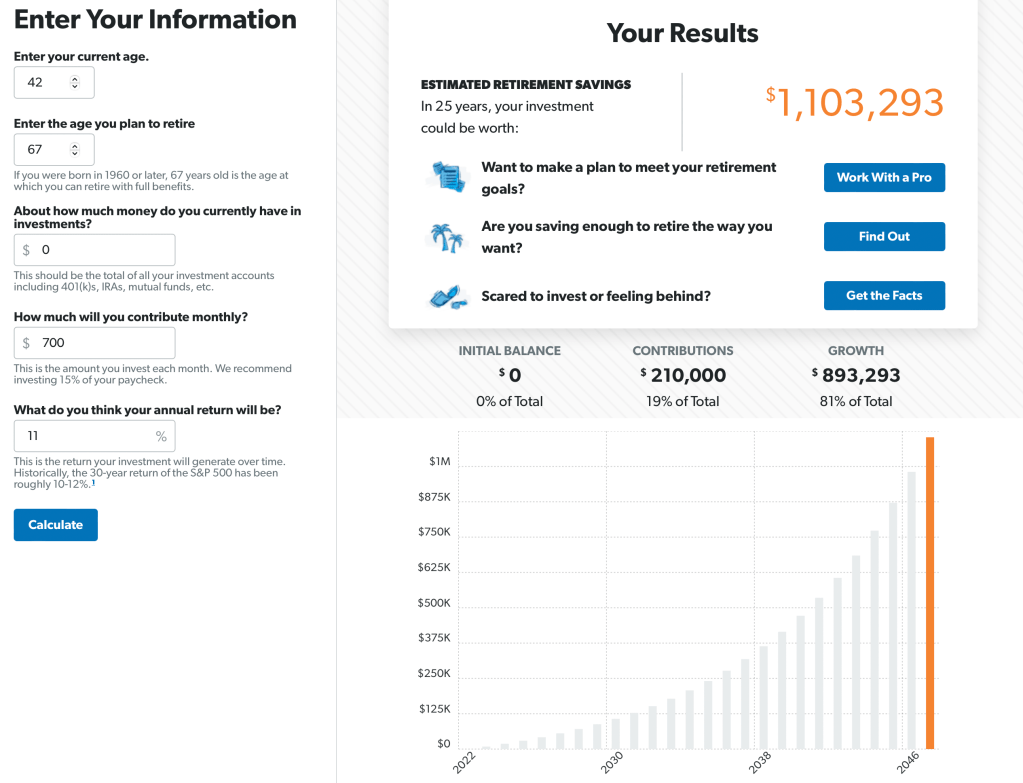

Check out this retirement calculator by Ramsey Solutions. Even if you started at 42 years old (halfway to retirement from 18-67) with ZERO initial balance and invested $700/month, you’d become a millionaire in 25 short years. Don’t believe me? I’ll let the numbers do the talking!

The great thing about this calculator, and many others is that you can insert your age, monthly contribution amount, and see how much you’ll end up with! It works magic for anyone. Now I get it’s hard for most of us to just believe that this little calculator knows everything. Technology isn’t always right, or at least I’ve been told that.

Let’s put some actual facts into the equation.

The crazy thing is that this above calculation was almost worst case scenario ($700/month from ages 42-67). I’m not even factoring in the employer match that your job might offer. I’m not asking if you could save up more money, or work another job, to get more retirement money. I’m starting halfway to retirement at age 42 with the numbers. Imagine the money avalanche that you could have at retirement if you are 35, or 20 years old. The reality is, all you might have to do is ditch the car payment and drive an older beat up car. Ask yourself, why do we all need $40k cars anyway? Are we trying to impress society?

Do You Want to Retire?

In a study recently, less than 1 in 4 Americans nearing retirement age believe that they will be able to retire comfortably. What does comfortable even mean in this crazy intense world nowadays? Generally accepted by many now is that you need 70-80% of your working salary income to enter retirement. This is affected by many factors including mortgage, bills, and whether you want to travel or stay local in your later years. You might even pick up an expensive hobby like golf – keep this all in mind when planning your retirement.

I personally don’t think waiting UNTIL retirement age (60’s) is a good plan for my retirement. I also don’t have the most enthusiasm in our government and their social security program to support me single-handedly in my elderly years.

So what’s your plan?

Regardless of your age, income, and other excuses, you CAN start today. You can choose to take control of your money, if that’s what you want to do. You can decide to retire in a beach house down south (Hey Florida!) if that’s what you want. Start dreaming about how you want your retirement to look – whether it’s 5 years away, or 40 years out.

The best time to plant a tree was 20 years ago. The second best time is now.

-Chinese Proverb

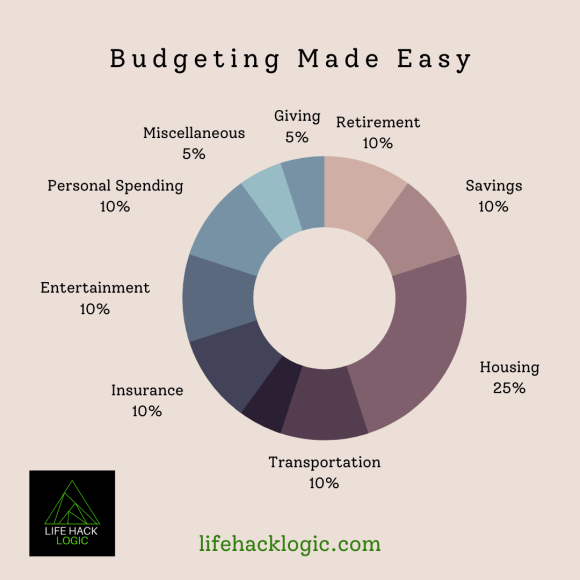

Once your goal is in place for retirement, make a plan. Can you drop your ridiculous car payment to set yourself up for the future? Can you skip the expensive coffee, or eating out a few times a month to help fund your financial future? I can. I am empowering people everyday to help do the same with their future.

Use my link here to get started with a retirement account on WeBull today. If you already have another retirement account, you are ahead of the game!

I highly recommend digging into these similar reads to keep you learning about and investing money:

Follow us on Instagram to keep in touch with our travels, here’s the latest posts: