It creeps up on most of us, and you have to be very careful. You get a nice promotion at work with a hefty raise. Your wife successfully launches her side business tutoring school kids on the weekends. You find yourself with more zeros on your bank account than you’ve ever seen. You have a choice of what happens next.

You see the neighbor’s sparkly blue BMW sitting out front of their mansion. You notice the new Mercedes they just bought their high school aged kid next. It’s getting hot out this Summer and you see them all kicking back and laughing out by the pool. You spend your own time mowing your lawn and doing landscaping almost every weekend to keep up a good curb appeal. But regardless of what you do, that pesky neighbor pays professionals to come out and spread grass seed, spray pesticides, and mow their yards. What is this, the freaking Biltmore House? You have a choice of what happens next.

With your new wealth, you could start paying for a better lifestyle. You could look cool like your neighbors do, at a cost. Everything comes at a cost. Part of this cost is that you are comparing yourself to your neighbor. This could be a lack of confidence. Jealousy. Or it could just be lifestyle inflation, creeping up in your mind. “Well I make more money now, I can afford nicer things.” You have a choice of what happens next.

See, I intentionally ended the last three paragraphs with the same line.

“You have a choice of what happens next.”

Powerful. I’ve learned that we get caught up in the small details. You make more money now, so you can afford more things right? Your neighbor has better things than you, well it must be time to keep up with the Jones’. But why?

Why can’t you make more money and keep the same old things you already have? Because you think you deserve better. Because capitalism and our culture teaches us that we all deserve nice and shiny new things ALL of the time. We all deserve the best. Even YOU can afford a nice BMW with the right financing terms. Marketing makes it seem like all of us can join the wealthy elites with the right utilization of debt.

Flip the Coin

You don’t have to play into lifestyle inflation. Do you know what you can achieve by keeping new found money in your possession? I do. If you manage to keep those greedy car companies, furniture stores, and other consumer products away, that can be powerful.

Imagine living the same life you have been, without purchasing a lot of new things. You could find contentment within the present. You don’t need a new car, a larger house, or a bigger ego. Imagine that.

Contentment is a process, a journey, and a way of life. Can you be content with less things than someone else has? Can you find happiness not within things – but within people and memories? Because I can. I know this exists, and I’m writing about these stories every day. I’m seeing people who walk this life every day. Financial minimalism can be achieved for anyone – who is willing to seek it out.

See, I also left out a key detail about that pesky neighbor we talked about earlier. They have the sprawling mansion, a BMW, the Mercedes, and a pool. Plenty of other things too that you could only dream of having one day. But they are struggling financially. They have so much debt that I’m convinced the father sold some organs to afford those things. They sit up at night wondering how they’ll afford the next thing. Their kid is spoiled and hasn’t learned the meaning of money. The mother and father argue to the point that their marriage is in jeopardy next. Does this look like the life you want?

Happiness doesn’t equal things. Do you really want to strive to be them? The material possessions will not improve your life. Buying too many things and living beyond your means often comes with a hefty price tag.

What Does Moving Forward Look Like?

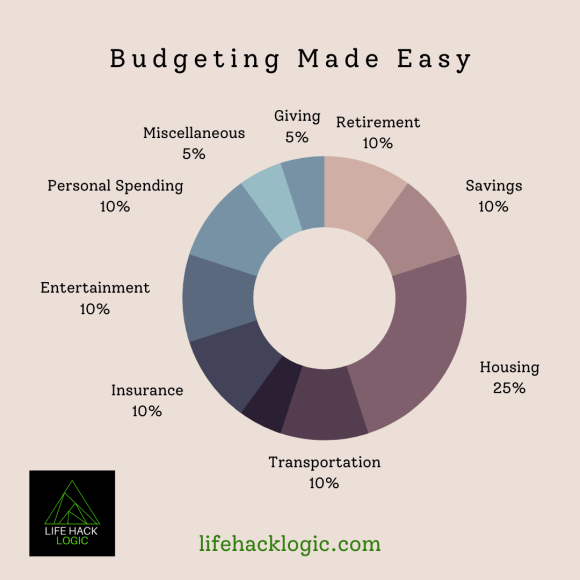

Decide what’s important to you. Do you want to put your family in jeopardy by buying too many consumer products? That’s exactly what can happen when you let a mountain of debt rack up higher than your bank account. Prosperity, which is the counter-opposite of struggling with debt, would look a whole lot better for your children one day.

Set your values. Are you the type that wants to never use debt again? If you are, start today. Cut those credit cards up, stop watching TV commercials, and run the opposite way of retail shopping. Anything in life starts with intentionality. Then you can build up over time from baby steps, to larger steps, of living and breathing a healthier air.

Regardless of which direction you choose to go in, remember that living beyond your means is not sustainable. Just because your neighbor or someone else has nice things, does not mean you need to compete with them. This also appears that they look good on the outside, but you don’t know how they are truly doing on the inside. Maybe you want nice things like they have, but you can choose to not go in debt over your head for them.

No matter how many things you own, you have to live with yourself. Do you want to own a lot of things, and be struggling financially? Or would you rather not own anything, and be able to smile and breathe normally? You can set the example for your children.

Here are some related reads that I highly recommend:

One reply on “Lifestyle Inflation”

Lifestyle inflation is a common trap to fall into, and we ned to be careful not to fall into it. Thanks for sharing!

Feel free to read some of my blogs 🙂

LikeLike